Introduction

Managing cash flow can often feel like navigating a complex maze, especially for small and medium-sized business (SMB) owners without a financial background. The good news is that with tools like CashCatalyst, simplified cash flow management is not just a dream—it's a reality. This blog will explore how CashCatalyst provides user-friendly financial reporting, real-time cash flow tracking, and AI-driven insights to help you take control of your finances without the stress.

The Importance of Simplified Cash Flow Management

Understanding Cash Flow

Cash flow is the lifeblood of any business. It refers to the movement of money in and out of your business, and managing it effectively is crucial for sustainability and growth. Unfortunately, many SMB owners find traditional accounting tools overly complicated, leading to confusion and stress.

Why Choose CashCatalyst?

CashCatalyst stands out by offering a solution tailored specifically for non-financial users. Here's how it addresses common pain points:

- User-Friendly Financial Reporting: Generate reports effortlessly without needing extensive financial knowledge.

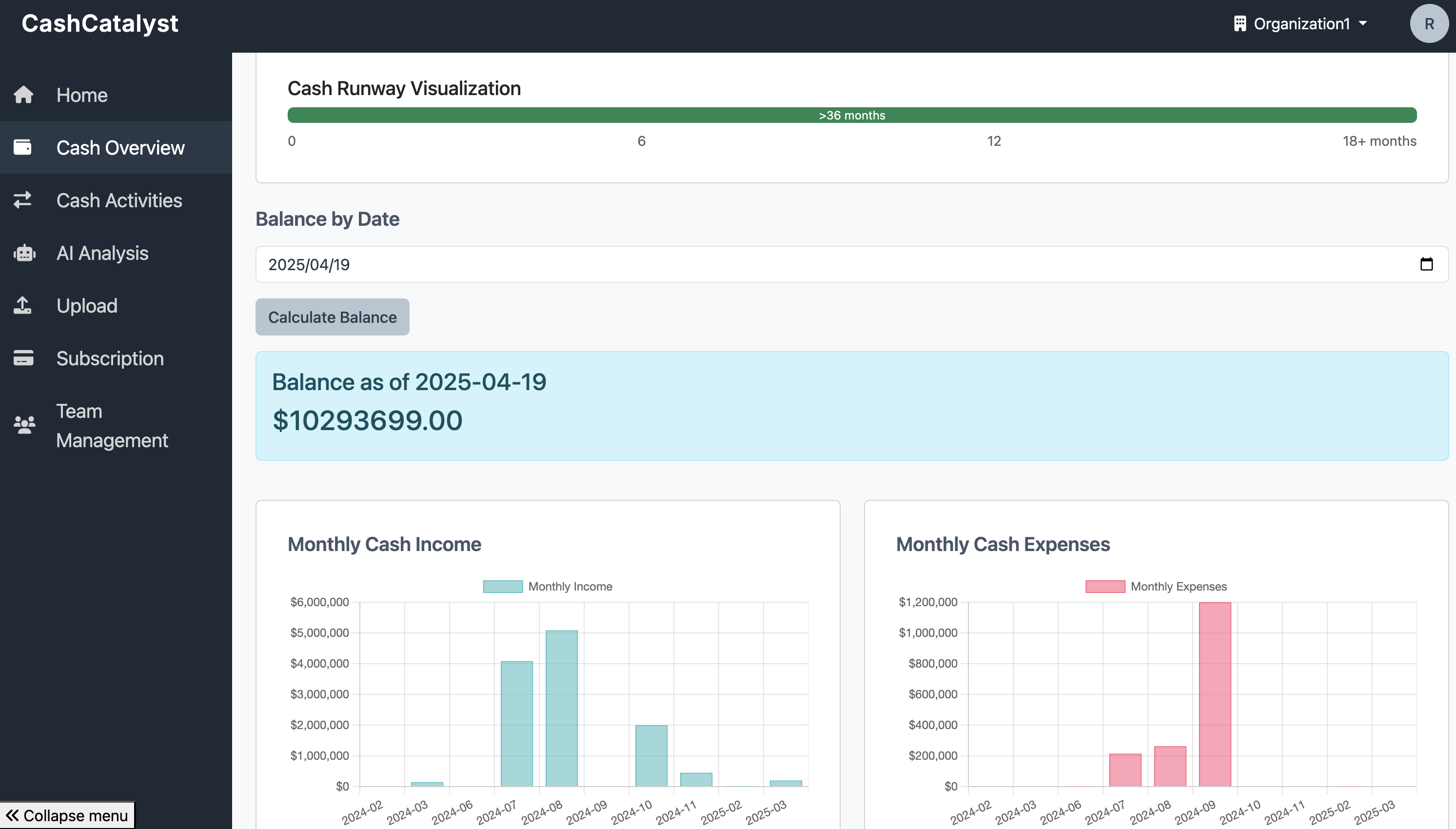

- Real-Time Cash Flow Tracking: Monitor your cash flow as it happens, giving you immediate visibility into your financial situation.

- AI-Driven Financial Insights: Leverage advanced technology to simplify cash flow analysis and decision-making.

Key Features of CashCatalyst

-

Stress-Free Cash Management

Managing finances shouldn't be a source of anxiety. CashCatalyst is designed to alleviate the pressures of cash management, allowing you to focus on growing your business.

-

Intuitive Expense Tracking

With an intuitive interface, tracking expenses becomes a breeze. You don't need to be tech-savvy or have a finance degree to navigate the app effectively.

-

Cash Flow Forecasting Made Easy

Forecasting cash flow can be daunting, but CashCatalyst simplifies this process. The app provides easy-to-understand forecasts that help you plan for the future without the stress of complicated calculations.

-

Customizable Financial Reports

Every business is unique, and so are its reporting needs. CashCatalyst allows you to customize financial reports to suit your specific requirements, making it easier to share insights with stakeholders.

-

Actionable Cash Flow Strategies

CashCatalyst doesn't just provide data; it offers actionable strategies to optimize your cash flow. This empowers you to make informed decisions that enhance your business performance.

Implementation Tips

- Start with a Clear Financial Snapshot: Begin by importing your current financial data to establish a baseline.

- Set Realistic Goals: Use CashCatalyst's forecasting tools to set achievable financial targets.

- Schedule Regular Reviews: Dedicate 30 minutes weekly to review your cash flow insights.

- Leverage AI Recommendations: Don't ignore the AI-generated suggestions—they're tailored specifically to your business patterns.

- Integrate with Your Workflow: Connect CashCatalyst with your existing business tools for seamless financial management.

Beyond Financial Management

CashCatalyst isn't just about tracking numbers—it's about creating peace of mind. Users report a significant reduction in financial stress, improved sleep, and better work-life balance when they have clarity about their business finances. The intuitive design eliminates the anxiety many business owners feel when confronting their financial situation.

Conclusion

In today's fast-paced business environment, having a clear understanding of your cash flow is essential. CashCatalyst offers simplified cash flow management, AI-driven insights, and user-friendly tools that empower SMB owners to take control of their finances without the need for an accounting background.