CashCatalyst User Guides

Learn how to make the most of our platform with step-by-step guides

Getting Started with CashCatalyst

Welcome to CashCatalyst! This guide will help you get started with our platform and introduce you to its key features.

Creating Your Account

- Click on the "Sign Up" button on the homepage

- Choose a subscription plan that fits your needs

- Enter your organization name, username, email address, and password

- Accept the Terms of Service

- Click "Sign Up" to create your account

Dashboard Overview

Once logged in, you'll be taken to your dashboard, which provides a comprehensive overview of your cash position and recent activities. The dashboard includes:

- Current cash balance

- Cash burn rate

- Runway projection

- Recent transactions

- Quick access to key features

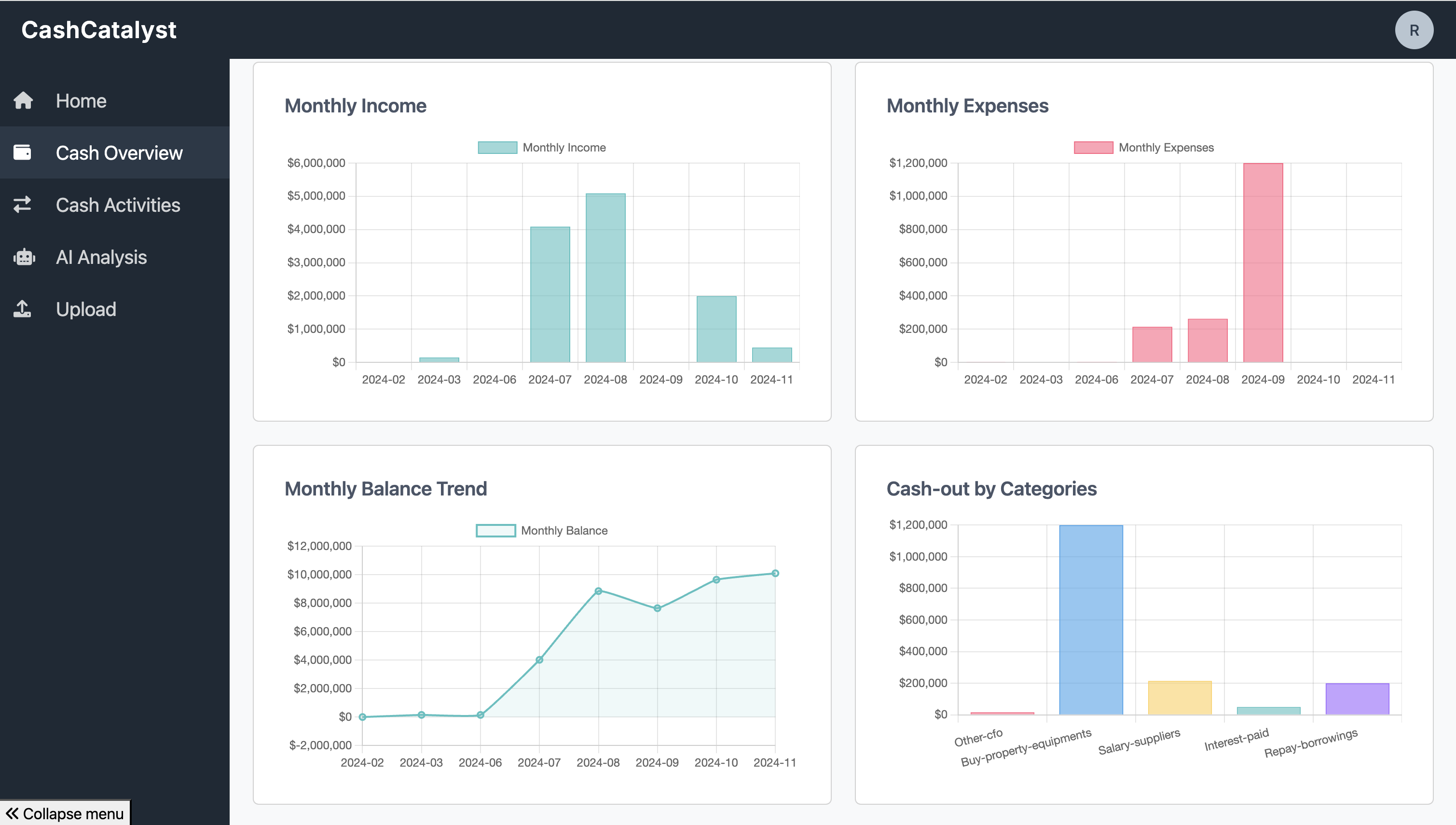

Cash Overview

The Cash Overview section provides visual representations of your cash position and movements over time.

Key Metrics Explained

| Metric | Description |

|---|---|

| Current Balance | Your total available cash at present |

| Initial Balance | Your starting cash position |

| Cash Flow from Operations (CFO) | Cash generated or used by your core business activities |

| Cash Flow from Investing (CFI) | Cash from investment activities like purchasing equipment |

| Cash Flow from Financing (CFF) | Cash from financing activities like loans or investor funding |

Available Charts

CashCatalyst provides several visual charts to help you understand your cash position:

- Cash Balance Over Time: Track your cash position across weeks, months, or years

- Cash Flow Components: Visualize the breakdown between Operating, Investing, and Financing activities

- Income vs. Expenses: Compare cash inflows against outflows

- Transaction Categories: View spending by category

Cash Activities

The Cash Activities section is where you record and manage all your cash transactions.

Recording Transactions

- Click the "Add Transaction" button

- Enter the transaction date

- Enter a description

- Input the amount (positive for income, negative for expenses)

- Select the transaction type (Operating, Investing, or Financing)

- Click "Save" to record the transaction

Managing Transactions

- Edit: Click on any transaction to modify its details

- Delete: Remove transactions that were entered in error

- Filter: Sort transactions by date, amount, or type

- Search: Find specific transactions using keywords

Setting Initial Balance

To set or update your initial cash balance:

- Navigate to the Cash Activities page

- Locate the "Set Initial Balance" section

- Enter your starting cash amount

- Click "Set Initial Balance"

Exporting Data

To export your transaction data:

- Click the "Export" button on the Cash Activities page

- Select your preferred format (CSV, Excel)

- Choose the date range for transactions to export

- Click "Export" to download the file

AI Analysis

The AI Analysis feature uses advanced algorithms to provide insights and forecasts based on your cash flow data.

Available Analyses

- Cash Flow Pattern Recognition: Identify trends and patterns in your cash movements

- Burn Rate Analysis: Calculate how quickly you're using cash and when you'll need more

- Runway Forecasting: Project how long your current cash will last

- Cash Flow Statement Generation: Create professional cash flow statements automatically

- Seasonality Detection: Identify cyclical patterns in your cash flow

How to Use AI Analysis

- Navigate to the AI Analysis section

- Select the type of analysis you need

- Choose the relevant time period

- Click "Generate Analysis"

- Review the insights and recommendations

- Export or share the analysis as needed

File Uploads

Save time by importing multiple transactions at once using the file upload feature.

Preparing Your File

Create a CSV file with the following columns:

- date (format: YYYY-MM-DD)

- description

- amount

- type (Operating, Investing, or Financing)

date,description,amount,type 2025-01-15,Customer Payment,5000.00,Operating 2025-01-18,Office Supplies,-150.50,Operating 2025-01-20,New Equipment Purchase,-2000.00,Investing 2025-01-25,Loan Repayment,-500.00,Financing

Uploading Transactions

- Navigate to the Upload section

- Click "Choose File" and select your CSV file

- Review the preview of transactions to be imported

- Confirm the import by clicking "Upload"

- Review the confirmation message showing successful and failed imports

Subscription Plans

CashCatalyst offers different subscription plans to meet your business needs.

Free

$0/mo

- 10 transactions/month

- Basic reporting

- Single user

- Team management

Pro

$19/mo

- 50 transactions/month

- Advanced reporting

- AI analysis features

- Up to 3 team members

Business

$49/mo

- Unlimited transactions

- Full AI analysis suite

- Unlimited team members

- Priority support

Upgrading Your Plan

To upgrade or change your subscription plan:

- Navigate to the Subscription Management section in Settings

- Review the available plans

- Select your desired plan

- Enter your payment information

- Confirm your subscription change

Team Management

Collaborate with your team by providing them access to your CashCatalyst account.

Adding Team Members

- Go to the Team Management section

- Click "Invite Team Member"

- Enter the email address of the person you want to invite

- Select their role (Admin or Member)

- Click "Send Invite"

Managing User Roles

| Role | Permissions |

|---|---|

| Admin |

|

| Member |

|

Cashflow 101: Key Concepts

Understanding basic cash flow concepts can help you make better financial decisions for your business.

Cash Flow Components

Operating Cash Flow (OCF) represents the cash generated by your company's core business operations.

Examples: Customer payments, vendor payments, employee salaries, rent, utilities, supplies

Why it matters: Strong positive OCF indicates your core business is generating cash and is sustainable.

Investing Cash Flow (ICF) represents cash spent on or received from assets that will generate future benefits.

Examples: Purchasing equipment, selling property, buying investments, R&D expenses

Why it matters: Negative ICF often indicates growth as the company invests in future capacity.

Financing Cash Flow (FCF) represents cash received from or paid to investors and creditors.

Examples: Loan proceeds, loan repayments, investor funding, dividend payments

Why it matters: Shows how your business is financing its operations and growth beyond its internal cash generation.

Key Cash Flow Metrics

| Metric | Definition | Why It Matters |

|---|---|---|

| Burn Rate | The rate at which your business spends money, typically calculated monthly | Helps you understand how quickly you're using your cash reserves |

| Runway | How long your business can operate before running out of cash | Critical for planning financing needs and cash conservation strategies |

| Cash Conversion Cycle | The time it takes to convert investments in inventory and resources into cash | Shorter cycles indicate more efficient cash management |

| Working Capital | Current assets minus current liabilities | Indicates your ability to cover short-term obligations |

Cash Flow Management Best Practices

- Maintain a cash reserve for emergencies (3-6 months of expenses is recommended)

- Regularly review and update your cash flow forecasts

- Monitor your burn rate and runway consistently

- Balance accounts receivable and accounts payable timing

- Consider the timing of large purchases or investments

- Separate essential from non-essential spending

- Negotiate better payment terms with vendors and customers